Ready to Manage Entrepreneurial Finance, Young Agripreneur Camp Participants Are Enthusiastic to Attend the Inaugural Workshop

The Directorate of Agromaritime Community Development (DPMA) of IPB University has conducted the first workshop for participants of the Young Agripreneur Camp (YAC) program. This inaugural workshop was focused on aspects of entrepreneurial financial management.

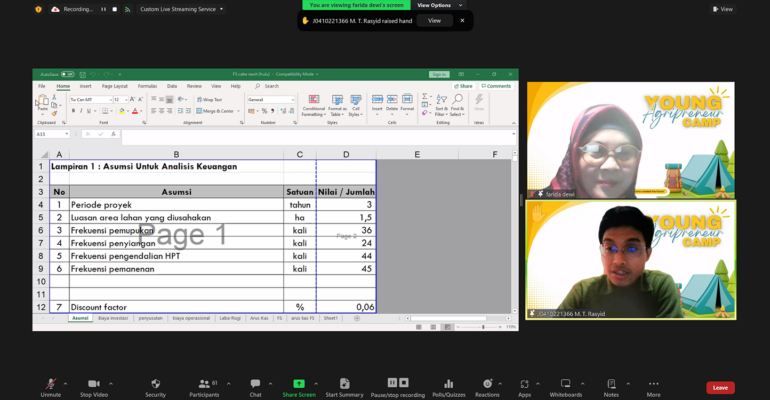

Young Agripreneur Camp is a program that is designed to prepare young people, especially IPB University students to work as entrepreneurs by increasing their knowledge and skills in cultivating high-value products. The resource person at this inaugural workshop was Farida Ratna Dewi, SE, MM, ME who is an expert lecturer in the field of entrepreneurial financial management.

On this occasion, she conveyed the importance of being familiar with financial planning for entrepreneurs in agriculture through budget management. This can be explored through data collection on the flow of costs such as basic needs, operational needs, and general needs as well as through the data collection of revenue streams including the results of sales and others.

The data collection, she said, is very important to be able to project clear business profits and be in a position to allocate the next budget for business development.

“Many businesses find it quite difficult to get projects with high benefits due to the absence of capital budgeting, so it is very important for an entrepreneur to record in a very detailed manner the business needs and revenue,” said Farida in her presentation.

She said that there are four decision criteria for capital budgeting, which are Payback Period (PP), Net Present Value (NPV), Profitability Index (PI), and Internal Rate of Return (IRR). Payback period is the knowledge of the number of years it requires to cover the initial expenditure. Net Present Value is defined as the net present value, or future net cash flow after subtracting taxes and initial project expenditure.

Profitability Index/Net Benefit is the present ratio of a net future cash flow to its initial expenditure. While the Internal Rate of Return is the level of return in balancing the present value of inputs with the value of outputs.

Farida also conveyed several points that must be done for an entrepreneur to manage business financial assets. She said, “ Begin with separating business and personal finances, working capital should not be used for personal purposes, profits should not be used entirely but there should be some saved, not too much capital is embedded in the product, and the length of goods turnover should be checked.”

The existence of this workshop is one of the important provisions for the next YAC participants who have an interest in running a business. The participants are expected to be able to be more prepared for all the needs, especially knowledge in managing finances so that the business they run can be sustainable. (*/Rz) (IAAS/ZQA)